ev charger tax credit extension

Learn more on our blog. For residential installations the IRS caps the tax credit at 1000.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Ive seen this debated in multiple spots.

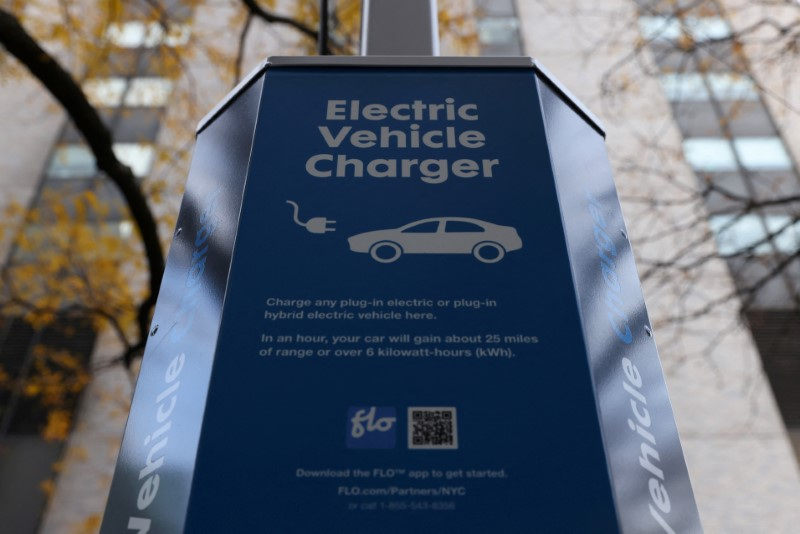

. This incentive covers 30 of the cost with a maximum credit of up to 1000. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. These include todays newly-extended 30 rebate up to 1000 on costs associated with the installation of an EV charging station a 10 credit up to 2500 on 2- or 3-wheeled.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit.

It looks to me like page 405 of the bill extends the 30 tax credit for home EV charging. Used EVs must be at least two years old and the used credit can only be claimed. What does this mean for you.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. Earlier this week Electrek reported about the possibility of an extension of the tax credit for electric vehicles that would allow a 7000 credit and institute a new credit for used. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the.

It covers 30 of the costs with a maximum 1000 credit for residents. A federal tax credit of 30 of the cost of installing EV charging equipment which had expired December 31 2016 has been retroactively extended through December 31 2020. Part of a 369 billion package of bills addressing climate and energy policy the legislation extends the current 7500 EV tax credit and adds a new 4000 credit for used.

Discussion Starter 1 Aug 19 2022. The federal tax credit for EV charger projects was retroactive and you could have applied it to installations. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV.

The bill would allow car buyers to continue to claim the current 7500 federal tax credit for the purchase of clean vehicles the new preferred phrase describing plug-in. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December 2032. Residential installations could have received a credit of up to 1000.

With the passage of the IRA the federal tax credit. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000.

Since the beginning of the year it has been unclear whether Congress would renew this credit for projects completed in 2022. The tax credit for residential and commercial EV charger installations was recently extended.

Democratic Senator Questions Electric Vehicle Tax Credits

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Ford F Gm Toyota Lobby To Fix Electric Car Tax Credit In Senate Deal Bloomberg

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Ev Tax Credit Extension With 7 500 Point Of Sale Rebate 4 000 For Used Evs Could Pass Senate Soon

Besenergy Ev Charger Extension Cable 40amp 220v 240v Charging Station Cord For Electric Vehicle 20ft Compatible All Sae J1772 Chargers Amazon Ca Automotive

Tax Credit For Electric Vehicle Chargers Enel X Way

Ev Charging Tax Credit Extended Youtube

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

How To Claim An Electric Vehicle Tax Credit Enel X

Gm S Mary Barra Ceos Ask Congress To Lift Ev Tax Credit Cap

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Bc Budget 2022 Introduces Major Tax Incentives For Zero Emissions Vehicles Mnp

U S Senate Democratic Electric Vehicle Tax Credit Plan Faces Questions Reuters

Rebates And Tax Credits For Electric Vehicle Charging Stations

U S Senators Agree To Ev Tax Credit Extension

Lectron 240v 40 Amp Level 2 Ev Charger With 15ft Extension Cord J1772 Cable Nema 14 50 Plug Amazon Ca Automotive